AP CFMS: Implemented by Andhra Pradesh Centre for Financial Systems and Services (APCFSS), CFMS is an enterprise-level application. AP CFMS stands for Andhra Pradesh Comprehensive Financial Management System and the broad outcomes expected from the implementation of the CFMS project include a “One Source of Truth” throughout the Enterprise (Government) accessible to all program participants, access to real-time information, ease of decision-making, speed and delivery of services, facilitation of all stakeholders, minimum reconciliation and financial development in Government.

|

| AP CFMS |

Vision Of AP CFMS

The vision of AP CFMS or Comprehensive Financial Management System is very unique and clear. The main vision of this system is to Establish a Financial System enterprise-wide that will enhance the efficiency of financial transactions.

It will also strengthen the effectiveness in control and transparency in operations. Accountability at every level and sustainability in the long run and to all the stakeholders will also be intensified.

Key Points:

- Efficiency does the RIGHT thing and in the context of the CFMS solution indicates results direction, prioritization and efficient use of resources, control and monitoring, timeliness and policy support.

- Stakeholder benefit means that participants (departments, departments, auditors, staff, pensioners, citizens, suppliers, contractors, teams, etc.) see the benefits in implementing the plan.

- Efficiency does the right thing and in the context of the CFMS solution defines speed, accuracy, consistency and reliability, minimal interface and return to investment

- The business model means that the CFMS solution will be based on a comprehensive process that breaks the bar/details of departmental services in order to facilitate decision-making taking into account the overall perspective of the situation.

- Transparency is stated in the timely and accurate dissemination and disclosure of information, data and decision-making processes to relevant stakeholders.

You may want to read this post :

Services Of CFMS

The services of CFMS or Comprehensive Financial Management System are categorised in a broad category. Here are the services under CFMS to cover the broad gamut of Government and its stakeholders:

- Government to Government (G2G)

- Government to Citizen (G2C)

- The Government to Employee (G2E)

- Government to Business (G2B)

How To Use CFMS Services

Using the wonderful services, provided by CFMS, is very easy to understand and operate. You can start using all the services of CFMS or Comprehensive Financial Management System by following these few steps:-

- Click here to visit the official website of CFMS. After clicking, you will be landed to the homepage of the official website

- Scroll the page and find the “Services” section, at the bottom of the page

- Select the services you want to use

- Submit your details

- After submitting your details, you will get further details to use your desired service

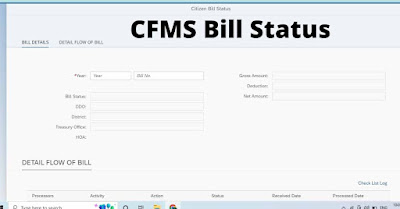

CFMS Bill Status

If you are wondering to check your AP CFMS Bill Status then you can do it very easily. Here is a quick tutorial to check your CFMS Bill Status.

Check CFMS Bill Status:

- Click here to visit the official website of CFMS. After clicking, you will be landed on the homepage of an official website

- On the homepage, you will find a “Citizen Services” column with expandable links. Hover your mouse there

- Now you will see the “Bill Status” link there. Click on it

- Now you will be redirected to the CFMS Bill Status page where you will be asked for a few details- Year and Bill Number

- Submit these details and click on the enter button

- Your CFMS Bill Status will be on your computer screen.

Also Read:

How to Download Quick SBI Samadhaan App for Android

CFMS ID – CFMS Beneficiary Search

If you want to search for your CFMS ID or CFMS Beneficiary then you can easily do it. Just follow these simple steps to search your CFMS ID:

- Click here to access the direct link to the AP CFMS ID Search page

- After clicking on this link, you will be landed in the CFMS ID Search

- On the new page, you have to choose an option by which you want to search your CFMS ID or CFMS Beneficiary

- You select any of these available options- Aadhar card, PAN card, Bank Account, Beneficiary number, Request number

- Enter the number of your selected option and click on the Search button

- Your CFMS ID or CFMS Beneficiary will be on your computer screen

- These details will be mentioned there- Beneficiary code, Name, Address, Aadhar number, PAN number, GSTIN number and Bank account number.

Also Read: SBI HRMS Portal Login

Scope Of Comprehensive Financial Management System

In terms of the vision and objectives, the entire scale is divided into broad policy areas (KPAs) – Budget Management, Revenue Management, Expenditure Management, Debt and Investment Management, Human Resource Management and Methods and Traffic Management. In terms of this classification, the high-level and granular goals and sub-objectives identified in each of the KPAs are:

- #1 Improved Financial Management by developing a seamless monitoring system (at a wider level of business) targeted revenue, collection/refund and real-time monitoring that enables greater control of unstructured and streamlined revenue collection through e-receipts to Government, broader access and minimal reconciliation by ensuring a single source of information.

- #2 Co-management through the various FD phases and other Government Departments to ensure a reduction in budget adjustments and the timing of the latest data distribution for this year which is expected to take place next year; the availability of real-time budget support and monitoring system support; reducing duplicate and non-productive work involves re-using paper use, and more control over fake drawls.

- #3 Improved credit management and investment management that will enable real-time access to credit information, loans, investments and outstanding guarantees in Government / Department / sub-offices and PSElevel including the complete management of the credit/loan life cycle, guarantees and investments.

- #4 Advanced Methods & Systems Management that may include real-time decision-making processes for key FD staff including a system that facilitates cash flow and financial management as well as minimal/timely reconciliation.

- #5 Improved Human Resource Management that can allow real-time observation for employees of various categories and facilitate their retirement from managing life cycle events; pension management and wage management.

- #6 Advanced Accounts Management can include:

- One source of information meets the analytical needs of all stakeholders;

- FD to have all the details about Government Accounts from its sources;

- Minor reconciliation between AG, Treasurer, Government Departments, Banks etc .;

- Real-time account availability – to ensure the prompt completion of monthly and annual accounts;

- Rare / risk-based audits and the evaluation and recruitment of draft audit structures that allow for timely and effective auditing;

- Paper crafts/craftsmanship; and

- Performing employee and debt-related debit information through multiple delivery channels

- #7 Improved Cost Management that can include:

- Real-time monitoring of all payments on monthly/quarterly/annual budgets;

- 100% budget management without causing difficulty for participants;

- One source of truth in terms of cost;

- Paper crafts / craftsmanship;

- Extensive control of misclassification;

- Workflow automation with the provision of targeted physical monitoring of financial progress;

- Allocation of cost management responsibility at the departmental level;

- Specified credit flow that ensures equitable distribution of work at all times;

- Decreased difficulty in the introduction/implementation of debt at the DDO level;

- Previous research focused on capital expenditure;

- Advanced authentication systems use Aadhaar based Biometrics and digital signature services; and

- Adequate system for monitoring PD accounts